GST HST Recording of Liability

This tutorial will show you how to record the liability for GST / HST remittance and how to pay it from Accounts Payable.

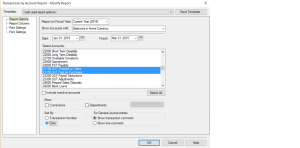

You need to first see how much is collected and how much is paid by viewing the General Ledger report.

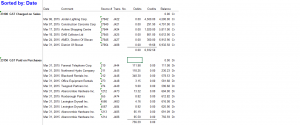

click ok and view the balances on the report. These are the amounts that have to be recorded in Purchase Journal and paid to CRA.

Note: I exported the Simply Accounting report into Excel so I can shrink it for better viewing.

Make sure the opening balance is 0 (nil) and always pay the amount in the balance colum.

The balance owing CRA is $6175.99 ($6932.58 – $756.59)

These amounts need to be recorded in the Purchase Journal.

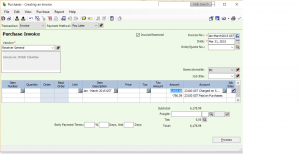

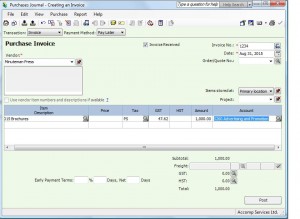

From the top make sure Transaction = Invoice

Payment Method = Pay Later

Invoice# = Jan-March 2015 GST (that is how I do it to keep track of each quarter posted)

Date = March 31, 2015 (represents the end of the quarter that your submitting the GST for)

Description = Use your own explanation, I just like to put the quarter I am working with.

Make sure the GST on Purchase amount has a – (negative) sign beside it so it will be reduced from GST on Sales.

and Process.

You have now set up the liability for the GST.

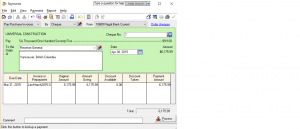

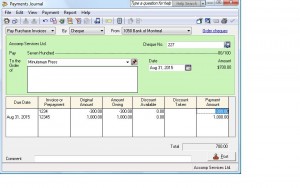

on the due date go to Payments journal and generate a chq.

You have now paid the balance due.

I hope this tutorial helped.

If you have other questions drop me a note.

Do a Payment Cheque with a Previous Credit

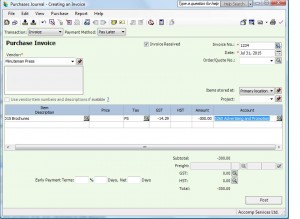

In the purchase journal I have a supplier invoice to pay as well as a previous credit that I posted for goods returned back to supplier.

Here, I have posted the invoice that needs to be paid.

The credit posted last month due to the product that was returned to the supplier.

Notice the credit beside the $300.00. looks like this. -300.00.

The net balance in the Payment Journal should be $700. payable to supplier.

Now lets go to the Payment Journal and see if it worked.

The net payable is $700.

Hope this helped and come back to my site for more tutorials.

Making life easy.