GST / HST setup for Provinces

This tutorial walks through how to set up sales tax (HST, PST and GST) for different provinces in Canada.

Lets get started.

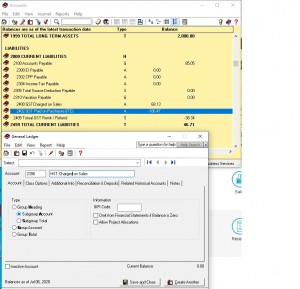

First we need to create an account in the Chart of Accounts to track the HST and GST charged on Sales.

go to Chart of Accounts and click on File – Create.

I created account number 2390 and called it HST charged on Sales. I already have GST charged on sales account. Make sure the Type is a Subgroup Account is ticked so it lands in the same area as other GST accounts. because when you get a report all the GST and HST on Sales will be in the same area.

Click Save and Close once your done.

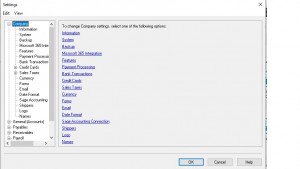

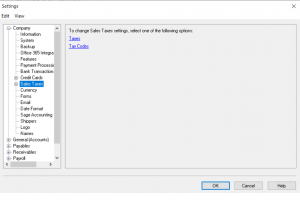

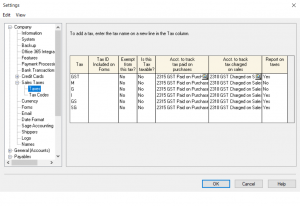

Now from the home screen drop down the Setup menu – Settings – Company and Sales Tax.

Once Sales Tax is chosen click on Taxes and add the new HST Charged on Sales account you just created and click OK.

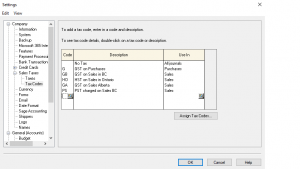

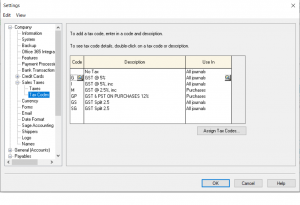

the system puts you back to the home screen. once again go back to Setup – Settings – Company – sales Tax and this time choose Tax Codes. List all the provinces that you sell to.

Now you need to give each province its own tax rate by clicking on each code and going deeper into the program.

the rest of the provinces can be set up the same with their own providential tax rate.

Hope this helped.

let me know if you have any other questions. Sorry for the delay in replying. I was helping our daughter and her kids this summer. But I am back at my desk.

Set up Tax Tables with Split Taxes

Hi everyone.

Recently I was asked how to set up tax table with split taxes.

ex: 5% GST (2.5% and 2.5%)

if you have man suppliers or customers with this type to of tax splitting you can set it up in the tax section.

if not I will show you how to enter it at the time of posting the invoice.

This tutorial will be in the classic mode as shown below.

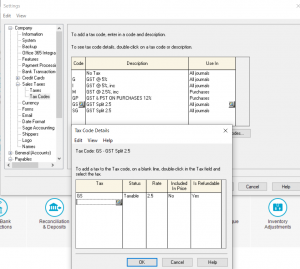

From the top menu choose Setup – Settings – Company – Sales Taxes.

This is where you should be.

From here chose Tax Codes below.

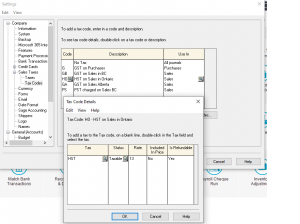

in this screen you will record all the tax code you have followed by a description.

you can also choose to see the tax code in a specified journal. either payable or receivable.

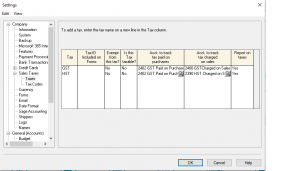

No click on Taxes below.

here you will issue the codes a relative account number. one for payables and one for receivables.

Now that we are familiar with the Taxes and Taxes Code screen.

lets go back to Taxes Code screen and choose the GS Tax Split in order to give it a percentage for calculate.

Do the same for the SG code and press OK.

Do the same for the SG code and press OK.

Now lets test the taxes created.

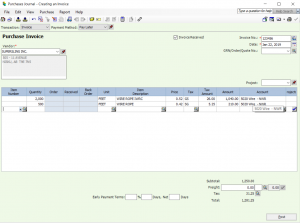

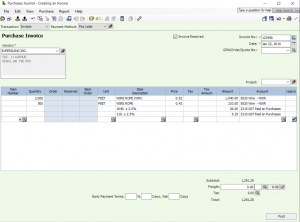

Go to purchase journal, choose a vendor and test the tax codes.

Now lets look at an entry with the tax codes not set up.

Hope this tutorial helped.

if you have other questions please drop me a note.

nk