GST Tax Table Setup

How to set up tax table in Sage 50

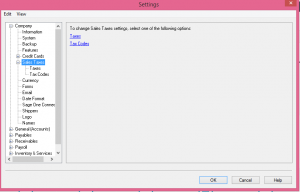

from home screen drop down Setup menu – Settings – Company – Sales Taxes.

First, lets click on taxes.

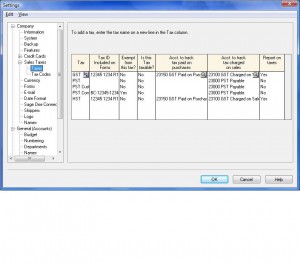

In the Tax colum you can give unique tax names.

In the Tax colum you can give unique tax names.

Ex: GST, HST, PST depending on the province.

indicate the account number that will be tracking this tax.

For payables account description “GST on Purchases”

and receivables account description ” GST on Sales”

These two accounts should already be setup in the chart of accounts in the liability section.

Ex:

account 2410 Description “GST on Purchases” ( for type choose the subgroup account)

account 2420 Description “GST on Sales” (for type choose the subgroup account again)

Account 2430 Description “Net GST Remit / Refund” (for type choose subgroup total)

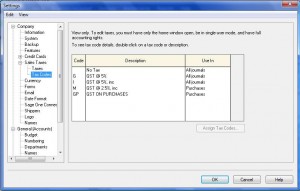

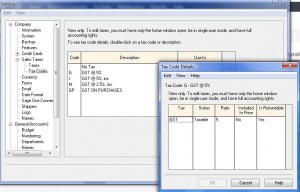

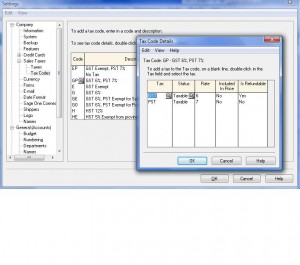

now, lets click on Tax Code

The code section is designated for your taxable goods.

The code section is designated for your taxable goods.

ex: GS and in the description section type: GST on Sales

GP and in the description section type: GST on Purchases

GV – and in the description section type: GST on Vehicle – if you are a company that uses a percentage of the vehicle for business and rest for personal than you have to take a percentage of GST as well. do not claim the full amount of GST when the vehicle is being used fa portion of time.

GM – and in the description section type: GST on Meals – The meals are expenses at 50% so the GST has been claimed at 50%.

in the USE In Colum – indicate if its for Vendor purchases or sales receivable.

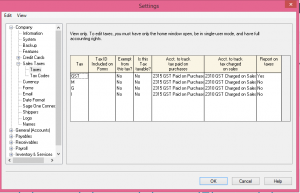

Now lets click on the first code “G”

In the tax colum you will put GST or PST, the name of the tax.

In the tax colum you will put GST or PST, the name of the tax.

Status is Taxable

Rate is 5% or other rate depending on the province

Included in price will be “yes” if its for tracking vendor taxes

it will be “No” if its for tracking sales tax

Is refundable will be “Yes” for GST and will be “No” for PST

Hope this helped with setting up tax tables.

Please send me note if you need further explanation.

GST/HST/PST Setup Tutorial

This tutorial will look at how to setup tax tables on Sage 50 Simply Accounting. Depending on where you do business your GST/HST/PST set up will be different.

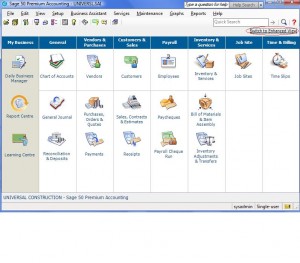

Below is the home page of Sage 50 Simply Accounting Classic View.

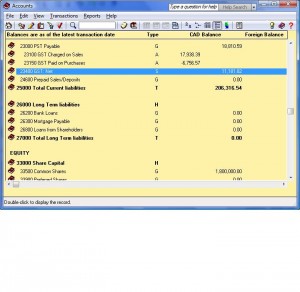

Step 1 – Create the necessary accounts in the chart of accounts. On home page click on Chart of Accounts. I have PST / GST accounts setup to track taxes. If you live in a province that collects HST create HST paid on purchases and HST charged on Sales. You do not need a PST account.

Step 1 – Create the necessary accounts in the chart of accounts. On home page click on Chart of Accounts. I have PST / GST accounts setup to track taxes. If you live in a province that collects HST create HST paid on purchases and HST charged on Sales. You do not need a PST account.

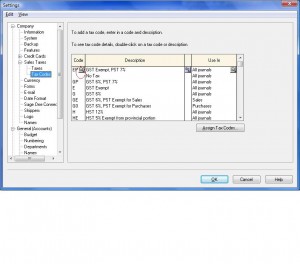

Step 2 – Now that we have our accounts created, lets create our tax table and link these accounts. From the setup menu click on Settings – Company – Sales Taxes and Taxes.

Step 2 – Now that we have our accounts created, lets create our tax table and link these accounts. From the setup menu click on Settings – Company – Sales Taxes and Taxes.

There are several colums in the setting stage. the first is the Tax Colum. Type you tax name used in your province.

Tax ID Included on Forms – type in the tax number issued to you by the government.

Exempt From this Tax? -Type No or Yes. they should all be No but in case of PST you could be exempt.

Is This Tax Taxable – Type No. There is no extra tax on top of this tax.

Acct. to track tax paid on purchases – this is where you would link the accounts you created to track taxes.

Do the same for tax charged on sales.

Reports on Taxes – You can allow Sage 50 Simply Accounting to give you a report on GST/HST to show how much taxes have to be paid to Revenue Canada or refund. I normally calculate it myself by printing reports. Watch GST Payable setup. http://www.simply-accounting-tutorial.ca/general-ledger/sage50-simply-accounting-record-gst-payable

Now that you have completed the initial set up lets go to tax codes.

There on three colums. under Code you can type in a 3 character code to represent the tax being charged. Give it a description and choose what journal it will be used for.

There on three colums. under Code you can type in a 3 character code to represent the tax being charged. Give it a description and choose what journal it will be used for.

Now lets go deeper and issue a tax percentage to the coded.

This tax is GST and PST charged on Sales. click on magnifying glass and choose GST. Status is Taxable. Rate is 6% (in this case) Included in Price is No (on the sales invoice the tax should show up on a separate line) Yes for Is refundable.

This tax is GST and PST charged on Sales. click on magnifying glass and choose GST. Status is Taxable. Rate is 6% (in this case) Included in Price is No (on the sales invoice the tax should show up on a separate line) Yes for Is refundable.

on second line choose PST. Status is Taxable. Rate is 7%. Included is price should be No (it will have to show up separately on your sales invoice). is refundable should be No (PST is not like GST and a refund will not be allowed for this tax. Once ou set up all your taxes. click Ok.

This concludes our tutorial. Let me know if you have specific questions. Click on the link ask question or leave comment.

Scroll all the way down the page.