Sage50 Simply Accounting Record GST Payable

Hi,

I think there is some confusion around GST / HST and how to get the appropriate reports and record the liability to Revenue Canada.

Here is a tutorial on how I figured it out. I think it’s the easiest way to do it if you don’t want to use Sage 50 tax function. I like to get the GST general ledger report myself so I am sure the proper amount is being paid.

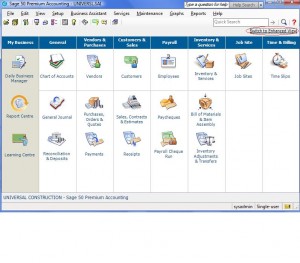

for this tutorial I will be in classic mode of Sage 50. this is the home screen.

From the Reports menu click on financials – Transactions by Account or General ledger (depending on the version of Sage 50 you have)

From the Reports menu click on financials – Transactions by Account or General ledger (depending on the version of Sage 50 you have)

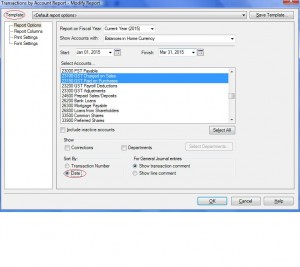

I Have some important fields circled. From the top, you can set this report as a template and give it a name. Make sure the fiscal year and the dates are within the time that you need. Mine is January to march 2015 the first quarter of GST. Some companies have yearly or monthly GST but for our purpase this is a quarterly GST remittance. pick your GST accounts and click on date. your report will be in date format and you dont want to see corrections. Click Ok.

This is your report. Make sure the balance forward is zero. in this example both GST accounts start off with a zero balance once the previous balance is recorded. Always choose the total in the balance colum to pay. this way if you make adjustments after remitting GST to Receiver General you can capture it in the next GST quarter as part of the balance colum.

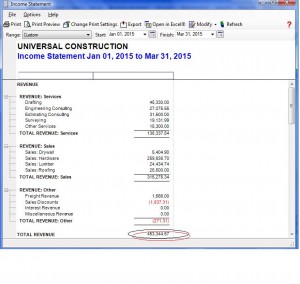

You also need to report net sales. Bring up an Income Statement report by dropping down the Reports menu – financials and income statement. Make sure your date reflects the January to March GST quarter and click ok.

Now you know what the GST collected on sales is, the GST paid on purchases as well as net sales for the quarter. Open the purchase journal and bring up the Receiver General vendor. We need to record the liability.

Now you know what the GST collected on sales is, the GST paid on purchases as well as net sales for the quarter. Open the purchase journal and bring up the Receiver General vendor. We need to record the liability.

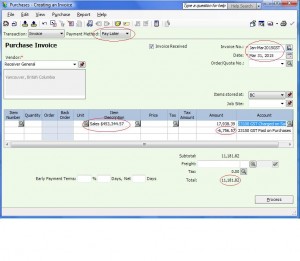

Here is how the purchase journal should be recorded. the entry should be as pay later. the invoice number should reflect the GST quarter for future reference and the date should be the last day of the GST quarter. record the net sales in description and the tricky part is to make sure to put a negative beside the amount for GST on Purchases. The net liability to Receiver General is $11,181.82.

Here is how the purchase journal should be recorded. the entry should be as pay later. the invoice number should reflect the GST quarter for future reference and the date should be the last day of the GST quarter. record the net sales in description and the tricky part is to make sure to put a negative beside the amount for GST on Purchases. The net liability to Receiver General is $11,181.82.

Hope this tutorial helped. If you a question or comment I would be happy to hear from you.

PST and GST Tax Table Setup Sage 50

Sage 50 PST and GST Tutorial

First, You need to create a PST Payable account in the chart of accounts. In home screen click on chart of accounts-file-create. In the current liability section, 2000 series account, create your account number and the description should be PST Payable and The account Type should be general. Save and close.

You should be back at home screen. Click on setup-settings-company-sales tax-taxes.

In the tax colum type PST and in the account to track tax on purchases and sales columns choose the PST Payable account number you just created.

Next step- click on tax codes on left side of screen. In the code colum type PG and in the description type PST and GST on sales and in use in colum drop down menu or double click and choose sales.

Last step, double click in PG you just typed in the code colum. In tax colum type PST , rate colum type 7, included in price choose No and is refundable choose Yes.

Second line, in tax Colum choose GST , in rate colum type 5 , included in price choose No and is refundable choose Yes.

For your convenient a complete tutorial can be found in a pdf format by clicking on the follwoing Link.