Cheque Format Under Reports & Forms

This tutorial is how to make changes to a pre-printed cheque.

In the home screen drop down the Setup menu – Reports & Forms.

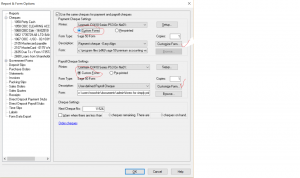

On the left hand side click on Cheques.

You can see that there are a lot of other forms that can be changed. But right now lets look at the cheques.

Pick the bank account that you need to change the cheque for.

on this screen there is a section for Payment Cheque Settings and Payroll Cheque Settings.

The Custom Form needs to be checked off in order to choose Customize forms.

Click on Customize Forms.

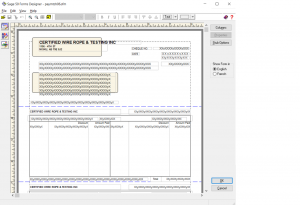

This is your cheque and you can change anything you want on it.

Once your changes are done you must save it. Click on File – Save As.

Make sure you know where you have save it and because there is payroll chq as well, it is a good idea to name the file Payroll or Payable cheques.

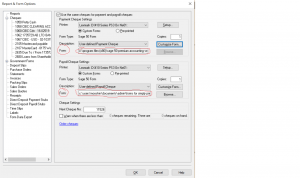

Click on OK once its saved.

The file name has changed. You can copy and paste the file name the file name from Payables and paste into Payroll.

The file name is important because that is where the program will look to get info to print the chq.

Hope this tutorial helped.

Let me know if you have other questions.

nk

Categories: 19- Setup & Settings Tags:

Accounts Payable Reversing an Invoice

Hello again,

This tutorial is how to reverse an accounts payable invoice that is not going being paid.

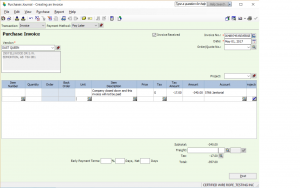

open the payable journal and select the vendor or supplier.

the entry should look like this.

From the top:

Transaction = Invoice

Payment Method = Pay later

Invoice = I entered the original invoice number followed by REVERS

Item Description = I just wrote an explanation why this invoice is being reversed. You can write your own so it makes since.

Amount = make sure their is a – (negative) sign beside the amount.

The GST should calculate automatically.

and Post or Record.

You can go into Payment journal as if you are making a payment. accept the two amounts, the positive and negative amounts. the net result to the bank is zero. and post. for chq number you can use the word LINK.

and Record.

Hope this helped.

Let me know if you have any other questions.

nk

Categories: 05- Purchases, Orders & Quotes Tags: