Hello,

This is part 3 of Linked Accounts & Integration. continuation of P1 and p2

Link Account & Integration P1.

Linked Accounts & Integration P2

Lets get started. Click on Payroll. there are 10 sub categories that will be covered.

Note: keep in mind depending on the version of Sage some of these categories might not appear.

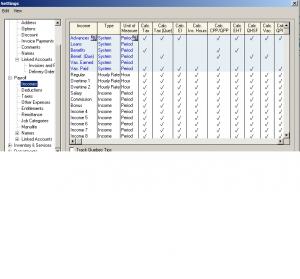

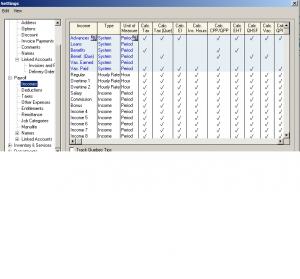

Next: Income

The shaded area can not be changed. There is regular, Overtime1 for 1.5% of regular wages and Overtime2 for 2 time the regular wages.

Income 4,5,6 etc can be changed to any other income categories such as piece work or one time severance pay or Xmas pay.

Going across the Colum each income category is checked off with the appropriate tax deductions.

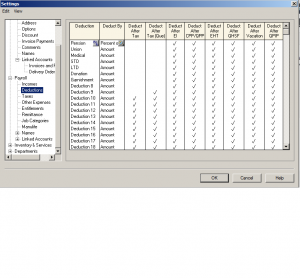

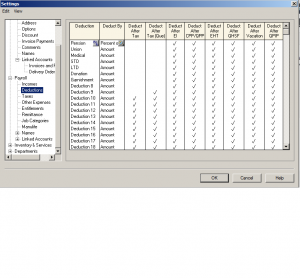

Next: Deductions

Enter all the appropriate deductions you may have. These will be set up on payroll and come off each pay period. Let the system know if any of the deductions are subject to government taxes.

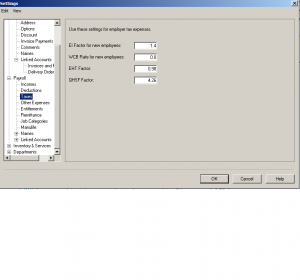

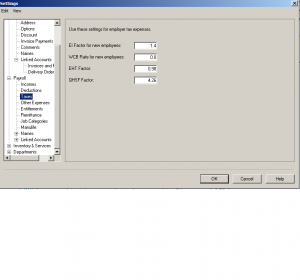

Next: Taxes

Next: Taxes

Use this section to calculate Employer portion of payroll tax remittance.

Next: Other Expenses

Next: Other Expenses

this section is self explanatory. Enter other expenses that you need to take off employees paycheque weather is amount or percentage.

Next: Entitlement

Employees sick, special, or any other day they may have can be tracked here.

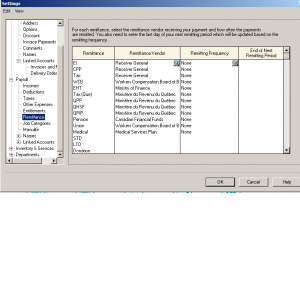

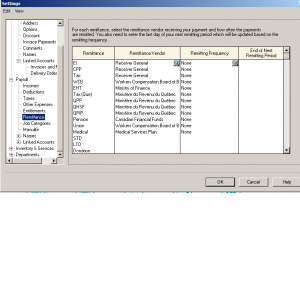

Next: Payroll Remittance

For each remittance select the vendor receiving payment.

Next: Job Categories

To add or change job categories fill in the information.

Next: Manulife

This is a extended health company for medical, RSP, or pension setup.

Next: Names – 2 sub categories.

1 – Income & Deductions

The blue section can not be changed. Income & Deductions 1 – 20 can be changed to your company’s preference.

2 – Additional payroll

this is additional info and title section can be utilized for your own wording and definitions.

Next: Linked account – 5 sub categories.

Income, Deductions, Taxes, User-defined Expenses and Expense Groups

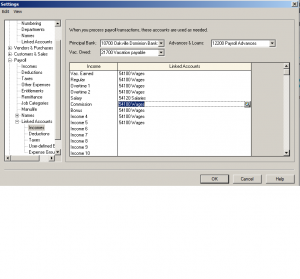

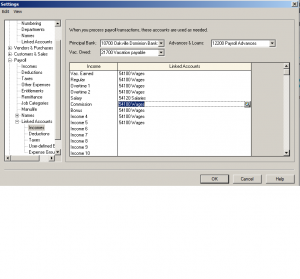

Next: Income

from top – Insert the bank that payroll will be coming out of. Account to keep track of vacation owed and account to track payroll advance.

the wages account number is issued to all wage categories except Salary has its own account number.

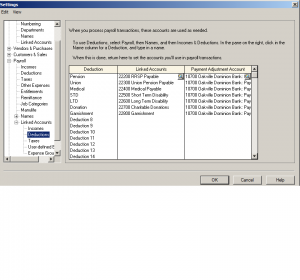

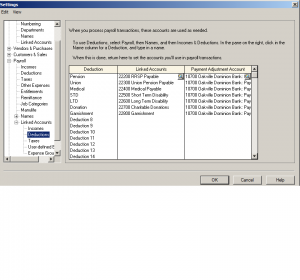

Next: Deduction

Next: Deduction

Enter all the payroll deductions account to balances every time payroll is processed.

These account should be reviewed each month and the balances remitted to government and other institutions.

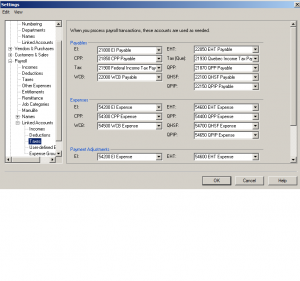

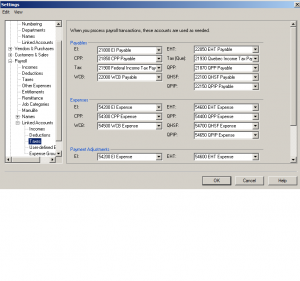

Next: Taxes

Every time payroll is processed the deductions will be held in these account. both the employee and employer portion so you don’t have to do extra calculations to capture 1.4% for EI and 2x CPP. Its already done for you.

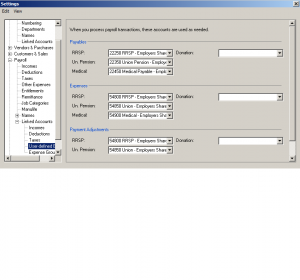

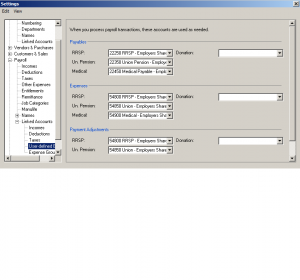

Next: User-Defined Expenses

When payroll is ran these accounts are used to process the payable section as well as the expense portion of the entry. The ones your company does not utilize can be left blank.

This concludes the Payroll setup and all the linked accounts to run payroll smoothly.

if you have any specific questions please drop me a note.

Hope this was helpful.

nk

Hello,

This is a continuation of P1 which talked about Company. under the Setup – Settings menu. the link is below for your review.

Link Account & Integration P1.

Lets continue with the tutorial. This section will look at integrating and setting up General (Accounts), Vendor & Purchases, and Customers & Sales.

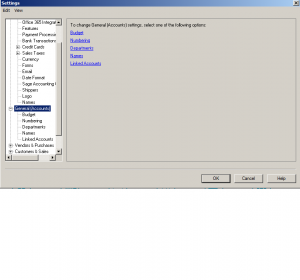

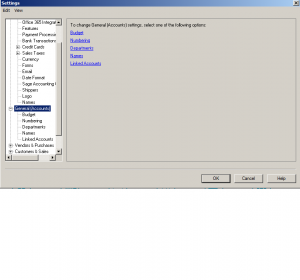

General (Accounts)

Under General (Accounts) there is Budget, Numbering, Departments, Names and Linked Accounts.

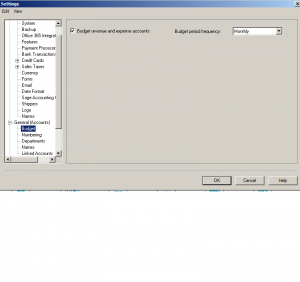

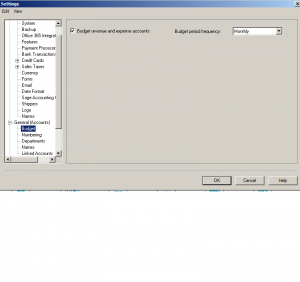

lets look at Budget

you can set up a budget for each of the accounts. A detailed and realistic budget is one of the most important tools to guiding your business and providing the information necessary to operate within your means.

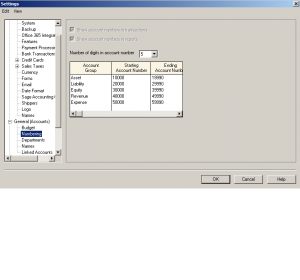

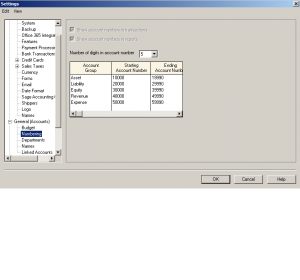

Next: Numbering

Next: Numbering

In Sage you can have a 5 digit account numbers and here you can specify the range.

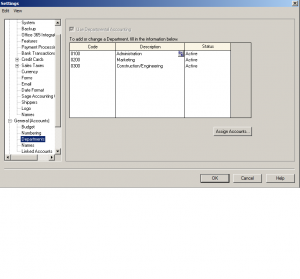

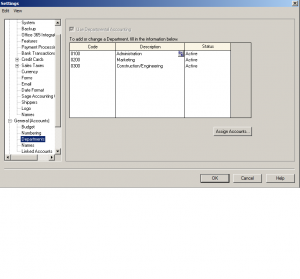

Next: Departments

Some companies need to separate departments and capture each departments expenses and income separately.

Next: Names

Next: Names

You can put anything you need to track in Names. this field can be used to sign off on documents.

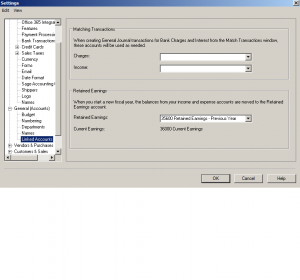

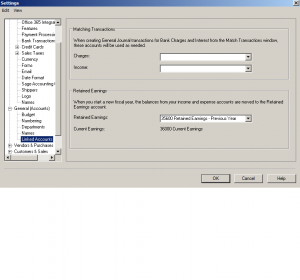

Next: Linked Accounts

This section is the integration section of Sage. Enter the account number for Current Earnings so that the system with know the account to used for Net Income or Loss calculations.

there is a Charges and Income section. If you add account number to this section it will use it for any over or underage that may occur during bank reconciliation or un-balanced transactions. I have left this blank because I want to choose the account rather a automatic entry.

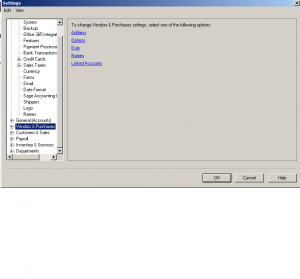

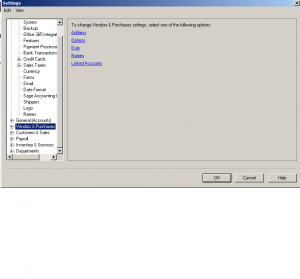

Next section is Vendor & Purchases with 5 sub sections t0 cover.

Address, Options, Duty, Names and Linked Accounts.

click on addresses

click on addresses

This is very handy and limits typing. enter a default address for new vendors.

Next: Options

Aging and Early payment terms.

Next: Duty

If your company imports or exports product the account that captures Duty can go here.

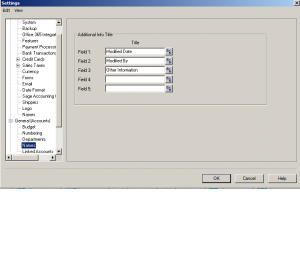

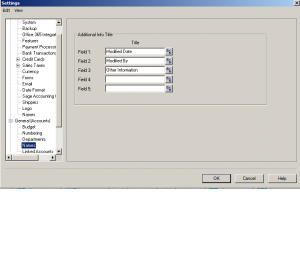

Next: Names

this Section is for Additional info titles and terminology.

if you like the Name Invoice to read Bills or Vendors to be called Suppliers, it can be changed here.

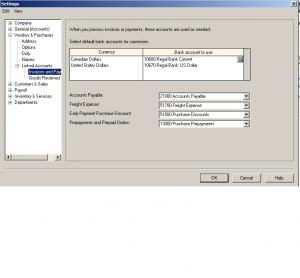

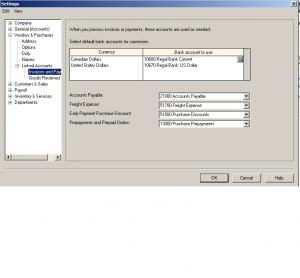

Next: Linked Accounts

This is 2 part integration section. The account numbers given here will be used to record transactions accordingly. the 2 parts are:

1- Invoice and Payments

2 – Goods Received Notes

Now, depending on what version of Sage Simply Accounting you have,

The Goods Received Notes may not be an option.

Lets first look at Invoice and Payments.

enter the bank account information and currency.

enter all the account numbers you created in the chart of account for these section. depending on your company some of these sections will be left blank.

not all companies give early payment discount or prepayment on orders. so fill out what is required for your business.

Next: Goods Received Notes

If your company is in a habit of producing Goods Received Notes and you like Sage to keep track of them, enter the account number here. Keep in mind to review these accounts often and purge out any notes not needed.

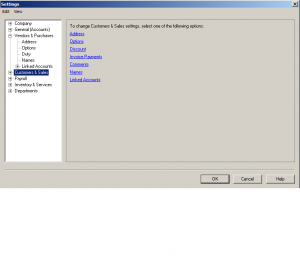

Moving on to Customers & Sales

this section has 7 sub sections to cover.

Address, Options, Discount, Invoice Payments, Comments, Names and Linked Accounts.

Next: Address

Enter the default address information for new customers.

Next: Options

Frist part of Options is Aging – normally customer invoices aging is 30 to 60 to 90 days.

Second part is Customer Statements – to set up interest charged on past due invoices as well as report options.

final section is tax code – this is a default tax code for new customers and if you need to track sales reps for commission purposes.

Next: Discount

Early payment discount – enter percentage discount paid within a certain date.

and this discount can fall on a line item for sales transactions.

Next: Invoice Payment

this is an online payment method. A 3rd party company register with a fee attached,.

you can contact Sage and install the 3rd party software compatible with Sage.

Next: Comments

The comment section is to make your invoices friendly. ex: A note thanking customers for their business. as well as for Contracts, Estimates and Delivery Orders.

Next: Names

Additional info Titles and Terminology. ex: change Customers to Clients or Sales to Service.

Next: Linked Accounts

This section has 2 sub sections:

1- Invoices & Receipts

2 – Delivery Orders

From the top enter the bank accounts for customer deposits and the second section is the linked accounts for Sage to track Accounts Receivable, Default Revenue, Freight Revenue, Early Payment Sales Discount, Deposits and Prepaid Contracts, Online Payments Receivable and Online Payments Fees.

Notes: Keep in mind you may not utilize all these sections depending on your business type. There might be unused sections so leave them blank.

Next: Delivery Orders

delivery orders are processed Sage can keep track and this is where the account numbers will be defined. Reconcile these accounts on regular basis to purge what is not needed.

This concludes P2 of this tutorial.

In part 3 will look at payroll and the link is blow for your review.

http://www.simply-accounting-tutorial.ca/category/payroll-cheque-run