Sage 50 tutorial on setting up Credit Cards Accepted

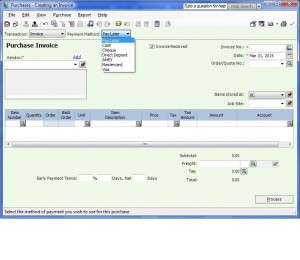

this function showes you how to setup credit cards and debit cards that you used in your business to make purchases. When you go out for meals with clients and use your credit card to pay, You need to enter that expense in the sage 50 accounting program. In the purchase journal your current choices are: Pay later, cheque, cash. You can now add credit and debit cards to that list. Here is how you do it.

From your home screen under the setup menu click on settings, company, information and credit cards.

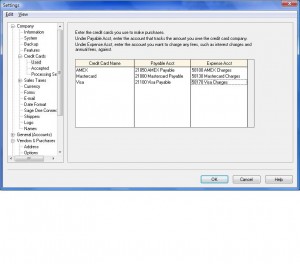

On this screen you can enter the debit or credit used in your company.

On this screen you can enter the debit or credit used in your company.

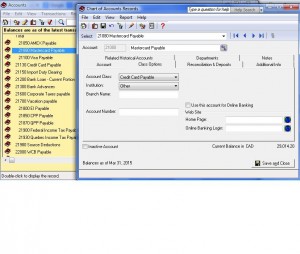

In some cases the account number does not show up which means the acccount class in not setup as a bank or credit card. this is how you change the account class. go to chart of accounts and pick the account you need to link. drop the account class tab and choose credit cards or if not available choose bank.

In some cases the account number does not show up which means the acccount class in not setup as a bank or credit card. this is how you change the account class. go to chart of accounts and pick the account you need to link. drop the account class tab and choose credit cards or if not available choose bank.

I hope this helps to speed up your purchase journal entries. Check back with us as I will have new tutorials or drop me a comment if you need a hand for something specific. Until next time.

I hope this helps to speed up your purchase journal entries. Check back with us as I will have new tutorials or drop me a comment if you need a hand for something specific. Until next time.

PST and GST Tax Table Setup Sage 50

Sage 50 PST and GST Tutorial

First, You need to create a PST Payable account in the chart of accounts. In home screen click on chart of accounts-file-create. In the current liability section, 2000 series account, create your account number and the description should be PST Payable and The account Type should be general. Save and close.

You should be back at home screen. Click on setup-settings-company-sales tax-taxes.

In the tax colum type PST and in the account to track tax on purchases and sales columns choose the PST Payable account number you just created.

Next step- click on tax codes on left side of screen. In the code colum type PG and in the description type PST and GST on sales and in use in colum drop down menu or double click and choose sales.

Last step, double click in PG you just typed in the code colum. In tax colum type PST , rate colum type 7, included in price choose No and is refundable choose Yes.

Second line, in tax Colum choose GST , in rate colum type 5 , included in price choose No and is refundable choose Yes.

For your convenient a complete tutorial can be found in a pdf format by clicking on the follwoing Link.