Session Date

The Session date is important to Sage 50 as well as accounting and entering data.

The following are the different legal statuses a company can have.

Sole Proprietorship

Partnership

Incorporated

Non Profit

In the case of Sole Proprietorship and Partnership, the fiscal year end must be December 31. As per CRA.

Ex: if you started your business in March 2017 your fiscal year end must be December 31, 2017.

It will be a short year (9 months) but the following year will be 12 months.

in the case of Incorporation and Non Profit, you can have any fiscal year end you like but can not go over 365 days.

Ex 1: if the company start date is March 1, 2017, the fiscal year end can not go over February 29, 2018, must stay within the 365 days.

you also have the choice of having a December 31, 2017 year end but the first year of business will be a short year as well.

Ex 2: have a client who is operating as a Sole Proprietorship. He will bring me a big box of papers separated in month order. so I will have 12 folders (Jan – Dec 2017)

When I am ready to start on his account I will set the session date to December 31, 2017 and work within my range of Jan – Dec 2017. In this case it is not necessary to change the session date every day or very month. It is set for December 31, 2017 and I will work within the year. The system will let you know that I am entering in the previous months but I accept.

Ex 3: I have clients that are Non-Profit or Incorporated and when I am ready to enter their data I will look at the fiscal year end and weather they have payroll or not.

Lets say the fiscal year end is February 29, 2018 and they do have payroll. Their will be 12 folders in the box from March 1, 2017 to February 29, 2018.

I will set the session date for December 2017. I do this due to payroll. If the customer has paid wages I need the session date to remain as December 31, 2017 for if I advance in to January 1, 2018 all the tax calculations will be off for 2017 payroll.

Once I am satisfied that the payroll is correct, all Source Deductions have been remitted and the T4 and T4 Summary are complete, I will than advance in to January 2018.

I guess the only thing to keep in mind is that if you are a Non-Profit or Incorporated and have payroll, do not advance beyond December 31.

Hope this helped to lesson the confusion about session date.

Let me know if you have a specific question.

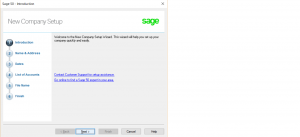

How to Start a New Company

You just purchased Sage 50 software and want to create a new company and began using all the features available to you.

than this tutorial is for you.

once you install the software and unlock by inputting the unique key code assigned to your sage 50 software.

double click on the icon on your desk top.

and choose create a company.

click OK.

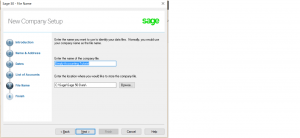

You are now at Create Company Setup.

Go Next.

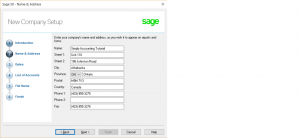

Input information in the fields.

Go Next.

My business status is Incorporated so the dates are April 1, 2017 to March 31, 2018.

If you have a sole proprietorship than you must have calendar year dates. (Jan – Dec).

Go Next.

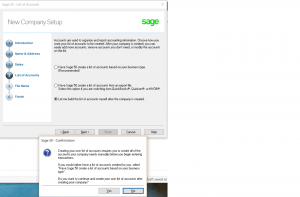

on the next screen you have 3 choices to create the chart of accounts.

I will choose to create the chart of accounts myself and I will show you how.

Go Next.

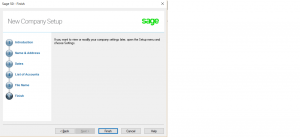

The system will give you a pep talk but click yes to go ahead.

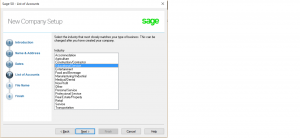

The next screen wants you to choose your industry.

If you choose Sage 50 to create your chart of accounts and all the linked accounts your industry will apply. Mine is Educational Services. Even though I will create the chart of accounts myself I will still let sage 50 know my industry.

Go Next.

The next screen is saving your file.

Choose a path that you will remember.

Mine is C:\Sage\Sage 50 Data\

This way you will always know where your data is stored.

You can also open up a folder called Back Up and put all your back ups under that folder.

Makes it easy, everything related to your sage 50 data is under one path.

This has nothing to do with installing the software.

the software installation was put under C:\program files.

(C:\Sage\Sage 50 Data\) is for the data file only.

click finish.

Now you have created your company.

Here is the link how to create the chart of accounts.